The Key Benefits of Executing Building And Construction Audit Practices in Building And Construction & Property Firms

The application of construction bookkeeping methods within building and realty firms offers various advantages that can considerably boost overall economic monitoring and project results. By establishing extensive budgeting and cost-tracking systems, companies can attain higher precision in monetary planning and capital management. These methods not only reduce mistakes however also help with notified decision-making through prompt accessibility to critical information. As the sector continues to progress, understanding the complete extent of these advantages ends up being important for preserving competitiveness and accomplishing lasting growth. What certain areas of economic management might generate one of the most substantial improvements?

Boosted Budget Plan Control

In the realm of building and construction bookkeeping, effective spending plan control is paramount for job success. Boosted budget control includes extensive tracking and management of funds throughout the job lifecycle. Precise budgeting ensures that expenses are approximated realistically, making it possible for firms to assign funds effectively and minimize the risk of overruns.

To attain boosted spending plan control, construction companies must employ detailed cost tracking methods, using innovative software application options that help with real-time data evaluation. This consists of breaking down project costs right into labor, materials, and above, permitting exact forecasting and changes as needed. Normal spending plan evaluations and variance evaluation are necessary in determining discrepancies in between forecasted and real expenditures, which can educate prompt decision-making.

Additionally, clear communication amongst job stakeholders is vital for keeping budgetary self-control. Establishing a culture of accountability guarantees that all group participants understand monetary restrictions and goals. By cultivating cooperation throughout divisions, firms can improve their capacity to reply to financial difficulties proactively.

Improved Money Flow Administration

Efficient cash circulation management is crucial for building companies, as it straight affects their ability to operate efficiently and meet job commitments. By utilizing robust building and construction accounting practices, companies can gain a clearer image of their financial position, permitting far better forecasting and source allotment.

One of the main benefits of enhanced capital administration is the capacity to expect durations of financial stress. Construction jobs usually entail considerable upfront prices and changing earnings based upon project turning points. With reliable monitoring of earnings and expenses, firms can recognize possible cash money shortages and implement methods to reduce them, such as securing lines of credit or readjusting repayment schedules with subcontractors.

Additionally, prompt invoicing and persistent follow-up on receivables can improve capital. By simplifying these processes, building and construction firms can guarantee that funds are readily available when needed, supporting recurring procedures and minimizing the danger of hold-ups because of pay restraints. In addition, precise capital forecasts enable firms to make informed decisions regarding financial investments in brand-new tasks, devices, or employees, cultivating lasting growth and stability within the organization. Inevitably, enhanced capital administration is indispensable for maintaining operational effectiveness and making sure long-lasting success in the affordable building and construction market.

Increased Job Profitability

Making best use of job earnings is weblink a fundamental goal for building companies making every effort to boost their financial performance. By precisely tracking task prices, firms can determine locations of overspending and apply rehabilitative procedures without delay.

Additionally, detailed financial reporting and analysis provide understandings into revenue margins for numerous projects. By assessing these margins, firms can make enlightened decisions on future proposals, ensuring they seek projects that align with their earnings goals. Furthermore, construction audit techniques promote much better communication amongst job stakeholders, cultivating partnership that can bring about cost-saving advancements and enhanced job execution.

Additionally, establishing a robust accountancy framework allows companies to precisely analyze their performance versus sector standards. This not only assists in recognizing strengths but also highlights weaknesses that need resolving, allowing continual improvement. Inevitably, increased task profitability not only reinforces a company's financial standing yet likewise boosts its affordable benefit in the building and construction and property market, leading the way for sustainable development and success.

Streamlined Financial Processes

Streamlined monetary processes are vital for construction firms aiming to boost see this website functional efficiency and accuracy in their audit methods. By making use of and applying standardized procedures specialized software program, firms can dramatically decrease the moment and effort invested in economic monitoring jobs. Automation of regular tasks, such as pay-roll, expenditure, and invoicing monitoring, decreases human error and ensures that economic data is processed quickly.

Furthermore, streamlined procedures help with better money circulation monitoring, an important element for building and construction companies where project timelines and budget plans can be unforeseeable. With real-time financial reporting, firms can monitor their financial wellness, enabling for quick modifications to alleviate any capital issues. This proactive technique helps keep supplier connections and maintains projects on time.

Incorporating building and construction audit techniques enables firms to consolidate various financial features, from budgeting to task costing, right into cohesive operations. This assimilation not only saves time but additionally advertises transparency and responsibility amongst staff member. Eventually, streamlined financial procedures contribute to a more active company, ready to react to market adjustments and task demands while ensuring that economic stability remains intact.

Educated Decision-Making Insights

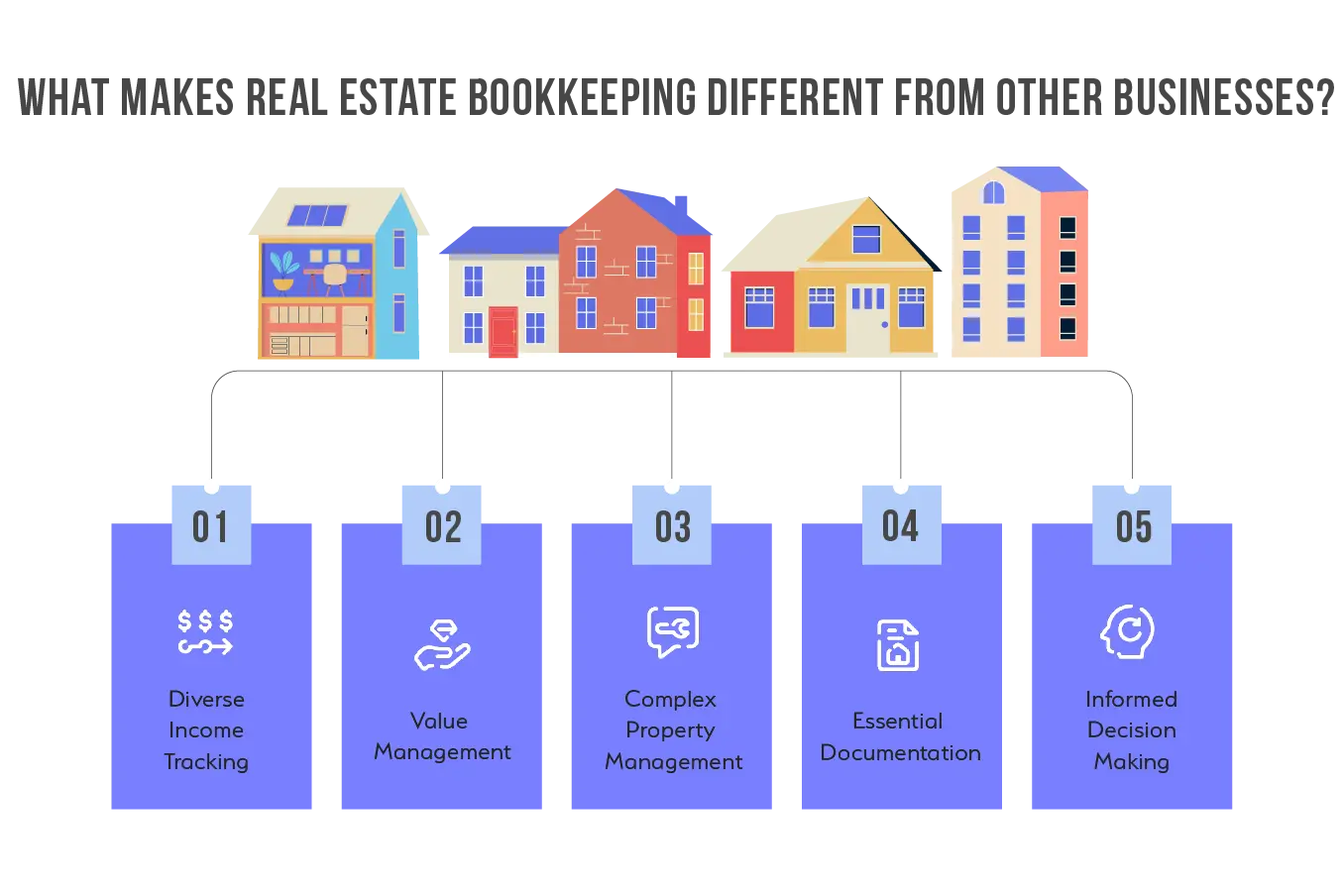

Educated decision-making is essential for building firms browsing complicated task landscapes and fluctuating market problems. By implementing durable construction accountancy practices, companies can leverage precise economic information to help with calculated options. This data-driven approach enables supervisors to evaluate task practicality, allot resources efficiently, and predict cash flow changes with greater accuracy.

Building accounting try this website offers understandings into cost management, enabling firms to identify locations of overspending and carry out rehabilitative procedures without delay. Comprehensive budget monitoring and variation analysis can disclose disparities between forecasted and real costs, informing future task bids and approaches. Real Estate Accountants. Furthermore, timely financial coverage improves the ability to reply to market modifications, ensuring that companies continue to be competitive and dexterous

Moreover, precise financial understandings foster much better communication with stakeholders, including customers and investors. Transparent monetary reporting constructs trust fund and confidence, as stakeholders can see the firm's financial health and wellness and task efficiency at a look. Ultimately, educated decision-making, backed by audio accounting methods, furnishes building and construction firms to navigate difficulties, maximize opportunities, and drive lasting growth in a significantly competitive market.

Verdict

In verdict, the implementation of building and construction bookkeeping techniques in construction and property companies substantially boosts monetary monitoring. By promoting enhanced budget plan control, improving money circulation administration, and enhancing job productivity, these practices add to streamlined monetary procedures and notified decision-making. The adoption of such methodologies not just promotes liability amongst stakeholders but likewise furnishes companies with the agility required to browse changing market conditions, ultimately bring about higher total success in job execution.

The application of building accountancy practices within building and real estate companies provides many advantages that can dramatically improve general monetary monitoring and task results. Building jobs usually include significant ahead of time costs and varying earnings based on job milestones. Furthermore, construction audit techniques help with far better communication among project stakeholders, cultivating partnership that can lead to cost-saving innovations and improved task implementation.

Incorporating construction audit techniques allows companies to settle numerous monetary features, from budgeting to task setting you back, right into cohesive operations. Construction Accounting. In-depth spending plan monitoring and difference evaluation can reveal disparities in between projected and actual costs, notifying future task quotes and approaches